Hong Kong’s ‘one country, two systems’ principle enables city to play key role in shaping global trends, John Lee says

“Hong Kong is the world’s pre-eminent gateway and a ‘super value-adder’ for economies, cultures and peoples, East and West.”

“Of course, all this is made possible by the unique one country, two systems principle. It affords us unparalleled access to mainland China, and the rest of the world. And we will continue to play an engaging role in defining and shaping the mega trends of the 21st century.”

Lee praised Hong Kong’s achievements in finance, innovation and sustainability, saying that there were about 1,000 fintech companies in the city, a 25 per cent jump compared with a year ago.

The city government has also invested more than US$25 billion in the innovation and technology sector, as well as about US$30 billion in green policy goals, he added.

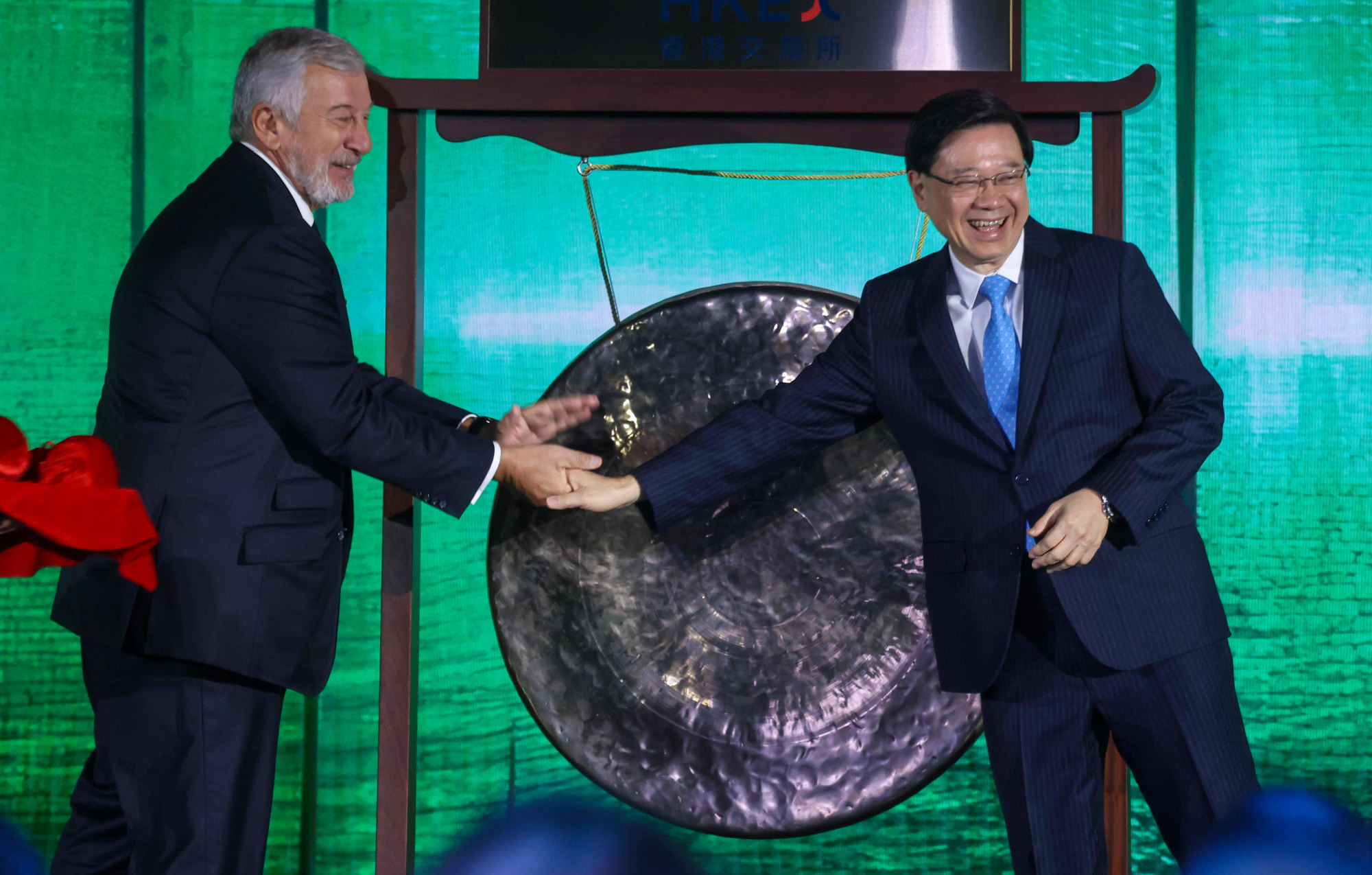

The conference was organised by the Future Investment Initiative Institute, a non-profit think tank run by Saudi Arabia’s Public Investment Fund, in partnership with the Hong Kong government and Hong Kong Exchanges and Clearing.

Hong Kong firms move to cut major deals in Middle East after John Lee’s visit

Lee said the event marked a significant step in the deepening ties between Hong Kong and the Middle East, particularly with Saudi Arabia, which he described as one of the “key nodes” of Beijing’s Belt and Road Initiative.

The belt and road plan is the central government’s trade initiative to link economies into a China-centred trading network.

The city leader noted that Hong Kong last week also saw the debut of CSOP Saudi Arabia ETF, Asia’s first exchange-traded fund from the country, which tracked the largest firms in the Middle East, including Saudi Aramco.

Saudi Arabia was among the destinations in Lee’s first overseas trip in February, as his administration looked beyond the West in an effort to widen sources of investment.

Asia’s first Saudi ETF gains in debut in milestone for China-Middle East ties

The city has been engaged in negotiations with Saudi Arabia concerning an investment promotion and protection agreement.

Hong Kong is the first Asian city to host the conference. Miami held the previous one in March, while two renditions of the event took place in New York and London in September and May last year.

Yasir Al-Rumayyan, the governor of the Saudi sovereign wealth fund involving more than US$700 billion in assets under management, attended the meeting as head of the delegation from the country.

The Post is the exclusive Asia-Pacific print media contributor for the event.