Burberry ousts chief executive; China economic growth disappoints – business live

Good morning, and welcome to our live coverage of business, economics and financial markets.

All change at the top of British fashion: Burberry has announced the departure of chief executive Jonathan Akeroyd after it was forced to cancel its dividend after a slump in sales.

Akeroyd has left the FTSE 100 company “with immediate effect by mutual agreement with the board”, Burberry said on Monday morning. Burberry has appointed American Joshua Schulman, a former Michael Kors boss, to replace him.

Gerry Murphy, Burberry’s chair said the performance was “disappointing”. He said:

We moved quickly with our creative transition in a luxury market that is proving more challenging than expected. The weakness we highlighted coming into full year 2025 has deepened and if the current trend persists through our second quarter, we expect to report an operating loss for our first half. In light of current trading, we have decided to suspend dividend payments in respect of full year 2025.

The data published by Burberry in its accompanying trading update do not make for pretty reading for shareholders: comparable store sales are down by 21% to £458m in the 13 weeks to 29 June.

In the Asia Pacific region sales are down by 23%. Revenues across the entire financial year could drop by 30%. Burberry said:

We are operating against a backdrop of slowing luxury demand with all key regions impacted by macroeconomic uncertainty and contributing to the sector slowdown.

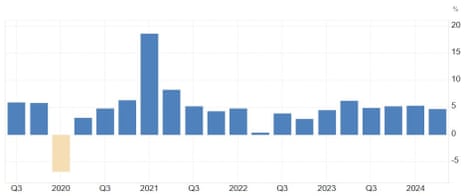

Chinese GDP grows by 4.7%, below 5.1% forecast

Buberry’s struggles have been put into context by Chinese GDP figures earlier this morning: growth slowed to 4.7% year-on-year in the second quarter, down from 5.3% in the first quarter and below the 5.1% expected by economists polled by Reuters.

China’s Communist party leaders are meeting for their “third plenum” this week, the forum that takes place about every five years at which they set out their long-term policies on the economy. The government is aiming for 5% growth in 2024, which may be a challenging target if the weakness persists.

The figures were “hampered mainly by weak consumer spending and demand”, said analysts at Deutsche Bank led by Jim Reid. They added:

Other data showed that China’s retail sales slowed to +2.0% y/y in June (v/s +3.4% expected and the worst since December 2022) after advancing +3.7% in May, thus highlighting that the world’s second largest economy is struggling to boost consumption. Adding to the negative sentiment, China’s home prices fell again in June, declining -0.67% on the month with existing home prices declining -0.85%.

The agenda

10am BST: Eurozone industrial production (May; previous: -0.1% month-on-month; consensus: 1%)

1:30pm BST: US New York Fed manufacturing index (July; prev.: -6; cons.: -6)