Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK housing market is continuing to pick up, the nation’s surveyors have reported, but renters are being squeezed by a fall in properties available to them.

The latest Royal Institution of Chartered Surveyors (RICS) Residential Market Survey has shown that UK house price growth turned positive across the country for the first time in almost two years.

More surveyors reported rising house prices in their area than falling prices in September, which ends a run of negative or flat returns for this indicator stretching back to October 2022.

RICS reports that most parts of the UK are experiencing rising house prices, although the West Midlands, South West and East Anglia are lagging behind.

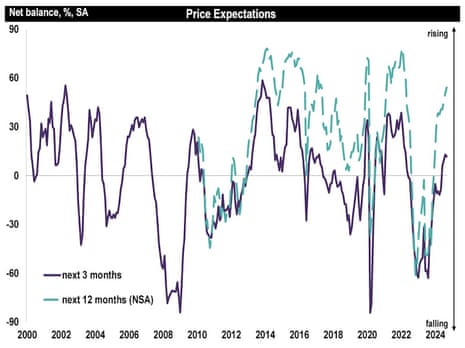

With borrowing costs expected to keep falling, prices are expected to rise across the UK in the year ahead.

Surveyors also reported that demand for homes, sales, and new listings all returned to growth last month.

RICS head of market analytics, Tarrant Parsons, says:

“The latest survey results once again convey a brighter picture for housing market activity, with the recent easing in mortgage interest rates continuing to support a recovery in buyer demand.

“Critical for the outlook, a further unwinding in monetary policy is anticipated over the months ahead, which should create a more favourable backdrop for the market moving forward. In keeping with this idea, forward-looking sentiment data from the survey points to sales volumes gaining impetus, both in the near-term and over the next twelve months.”

But renting a house in the UK is becoming harder, as demand continues to grow and outstrip supply.

RICS reports that demand from tenants increased again last month, while there was a drop in the number of properties listed for rent – possibly because landlords are fearful of capital gains tax (CGT) changes in the budget this month.

The group explains::

This trend is further influenced by some landlords listing their properties for sale before potential CGT rises. Unfortunately for renters, the continuing squeeze on supply will likely mean further rent rises and difficulties finding property.

The struggle to rent property has already led to a rise in rough sleeping last year. Homelessness charities warned yesterday that rough sleeping will head back towards record levels unless the government addresses a looming £1bn shortfall in frontline funding.

The agenda

9.30am BST: Bank of England’s credit conditions survey

10am BST: Post Office chief executive, Nick Read, to give evidence at the Horizon IT inquiry for the second day

1.30pm BST: US inflation report for September