Gold hits record high and bitcoin breaks $40,000 – business live

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Gold has climbed to a record high for the second session in a row, as investors flock to the traditional safe haven asset amid hopes of interest rate cuts in the months ahead.

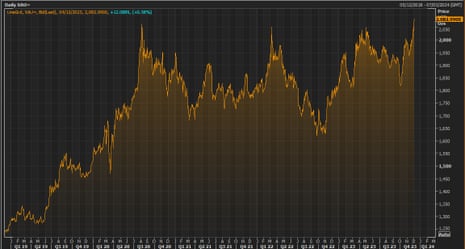

The gold price has hit $2,111.39 per ounce, taking it over the record set on Friday night and further above the previous record set in August 2020.

Gold has strengthened amid hopes that the cycle of interest rate increases over the last couple of years has now ended, and that central banks will turn their attention to cutting borrowing costs in 2024.

That has led to a weaker US dollar, which pushes up the gold price (as it’s priced in dollars).

As this chart shows, gold has climbed pretty steadily since the start of October, when it was changing hands at $1,820 per ounce.

Crypto assets are also on a charge, with bitcoin hitting $40,000 for the first time this year today, with some traders betting the US Federal Reserve could start cutting US interest rates next spring.

Kyle Rodda, senior financial market analyst at Capital.com, explains:

Markets are piling in on bets of Fed rate cuts next year, possibly as soon as March. That pushed gold and Bitcoin to critical levels, with the former busting to record highs and the latter hitting $US40,000 for the first time since May 2022.

Gold’s move boasted all the hallmarks of a technical melt-up, as the break of previous all-time highs set off stops and buy orders.

Gold hits new all-time high pic.twitter.com/nAckjfdVsH

— Simon Brown (@SimonPB) December 4, 2023

A lower interest rate environment would favour gold, which doesn’t generate a yield (unlike bonds, equities or current cash savings accounts).

Also coming up today

The UK economy will be under the microscope, as the Resolution Foundation thinktank holds an all-day event examining a better economic strategy for the country.

The UK has great strengths, but we're 15 years into a period of stagnation.

— Resolution Foundation (@resfoundation) December 2, 2023

It's time for a new economic strategy.

On Monday, we'll be launching the final report of the Economy 2030 Inquiry, with @CEP_LSE and funded by @NuffieldFound.

Online tickets ➡️ https://t.co/GjcuxLTaIY pic.twitter.com/U7rFZxci3w

Its work has shown that British workers are missing out on £10,700 a year after more than a decade of weak economic growth and high inequality.

Resolution will hear from Labour leader Sir Keir Starmer, who is expected to warn that he would not “turn on the spending taps” if he wins the next election

The Guardian reports this morning that Starmer will say:

“Anyone who expects an incoming Labour government to quickly turn on the spending taps is going to be disappointed … It’s already clear that the decisions the government are taking, not to mention their record over the past 13 years, will constrain what a future Labour government can do.”

“This parliament is on track to be the first in modern history where living standards in this country have actually contracted. Household income growth is down by 3.1% and Britain is worse off.

“This isn’t living standards rising too slowly or unequal concentrations of wealth and opportunity. This is Britain going backwards. This is worse than the 1970s, worse than the recessions of the 1980s and 1990s, and worse even than the great crash of 2008.”

The agenda

7am GMT: German trade balane statistics for October

9.30am GMT: Resolution Foundation holds event examining UK economy in 2030

2pm GMT: ECB president Christine Lagarde gives a speech at the Académie des Sciences Morales et Politique’s conference in Paris

3pm GMT: US factory orders for October