Комментарии 0

...комментариев пока нет

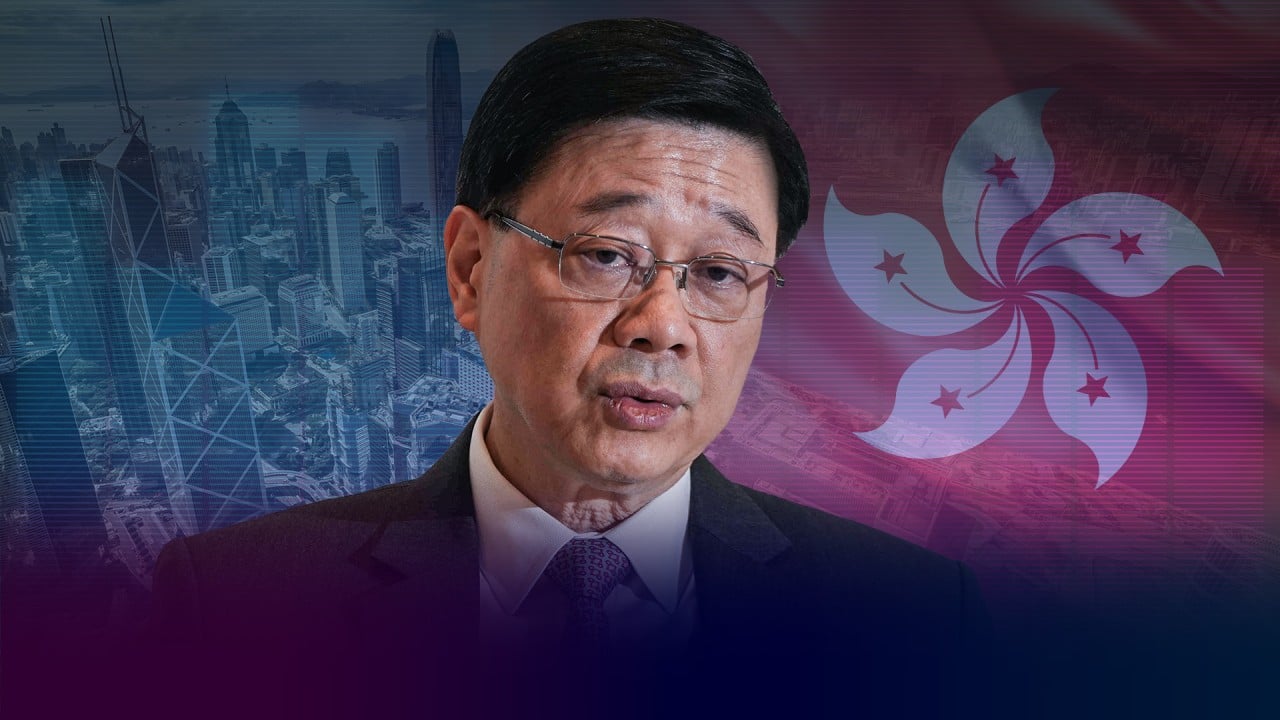

Rosy view of Hong Kong’s finances won’t prepare people for fee hikes

While other places, such as the mainland and Southeast Asian countries, managed to sort out the issue years ago, we will study the situation for another year and bring forward a draft bill by the end of next year. In other words, probably no proper Uber until 2026 at the earliest so don’t hold your breath.

I worry that we may be heading into similar territory with the growth forecasts for our economy and the effect on public finances. We may have left Hongkongers psychologically unprepared for fee increases for public services, which are on the way.

I make no bones that I am an unashamed bull on Hong Kong. I have every confidence in the long-term future of our economy and the solidity of our public finances, provided we continue to behave prudently. But we need to be careful about how we present the information to the community at large.

Take the economy, for example. The full-year forecast is for gross domestic product growth of 2.5-3.5 per cent, which is good. But these numbers need to be seen in the context of the last five years. Hong Kong’s economy has been on a roller-coaster ride, shrinking by 6.1 per cent in 2020, growing by 6.4 per cent the next year, then shrinking again by 3.7 per cent in 2022. At the end of last year, our GDP was smaller than in 2018 in weighted terms.

Lingnan University’s Professor Ho Lok-sang referred to these numbers during a radio discussion in May about the prospects of a civil service pay rise. A private pay trend survey had suggested increases of up to 5.47 per cent. The Executive Council, which also considered the state of the economy, ended up approving an increase of 3 per cent.

The government says Hong Kong’s public finances are sound, and I agree. We must keep them that way. The deficit figures the government quotes for the last two financial years are HK$122.3 billion (US$15.65 billion) and HK$101.6 billion. As I have pointed out before, this includes the proceeds of bond sales. But bonds are debt, not income, so after excluding them, the actual deficits are HK$188 billion and HK$173 billion.

The forecast for the current financial year is for a budget deficit of HK$48.1 billion including bonds, or HK$143.8 billion without. Taking these three years together, we will have dipped into our accumulated savings by more than HK$500 billion, albeit cash in hand will have been bolstered by bond sales of about HK$258 billion. The government has promised to restore fiscal balance over the next three years.

What this will mean for the man in the street is limited government scope for new initiatives involving greater spending; it will also mean higher charges for services. Several areas have been highlighted, including accident and emergency (A&E) charges in hospital, university tuition, water supplies and public housing rents.

In January, health secretary Lo Chung-mau said he was looking at increasing A&E fees, last revised in 2017, to deter non-urgent cases. Last month, Chief Secretary Eric Chan Kwok-ki said university tuition charges, which have not been adjusted for two decades, would rise by 17.6 per cent over the next three years.

Also in June, the Water Supplies Department said it was looking at increasing water charges – which cover only 79 per cent of costs and had not been adjusted for 30 years – in a “gradual and orderly” way.

Public housing rents are reviewed every two years, and the Housing Authority has informed the Legislative Council that rents will rise by 10 per cent starting October 1, but with a grace period of three months. Secretary for Housing Winnie Ho Wing-yin said the increase would be affordable for most tenants.

Are there any other candidates for fee revision? The post office must surely be a strong contender. The Audit Commission recently reported that Hongkong Post had made a loss in seven of the last 10 financial years. The situation is clearly untenable.

No doubt there is a whole raft of other fees and charges due, or overdue, for revision. Hong Kong people are not stupid. They know there is no magic money tree and the government needs to balance the books to pay its way. But it would be much more palatable if modest increases were introduced every few years rather than having to contemplate substantial rises after decades of neglect. And much better if the full scale of our deficits were presented in the open, rather than being masked by proceeds of borrowing.

Mike Rowse is an independent commentator