US-sanctioned Chinese chip start-up Moore Threads unveils GPU-based computing centre, AI graphics card

The US sanctions have made it challenging for the two companies to find wafer foundries that are willing to manufacture their chips, putting the firms in a similar predicament that Huawei Technologies has faced since late 2020.

The export restrictions also affect Moore Threads and Biren’s access to US electronic design automation software.

Moore Threads had been a darling of investors amid China’s chip self-sufficiency drive.

The company had raised a total of US$525.7 million as of December last year, including 1.5 billion yuan (US$205.4 million) from a Series B funding round led by Hexie Health Insurance and Hechuang Digital Private Equity Fund Management that gave it a pre-market valuation of 28.95 billion yuan, according to data from private equity market tracker PitchBook.

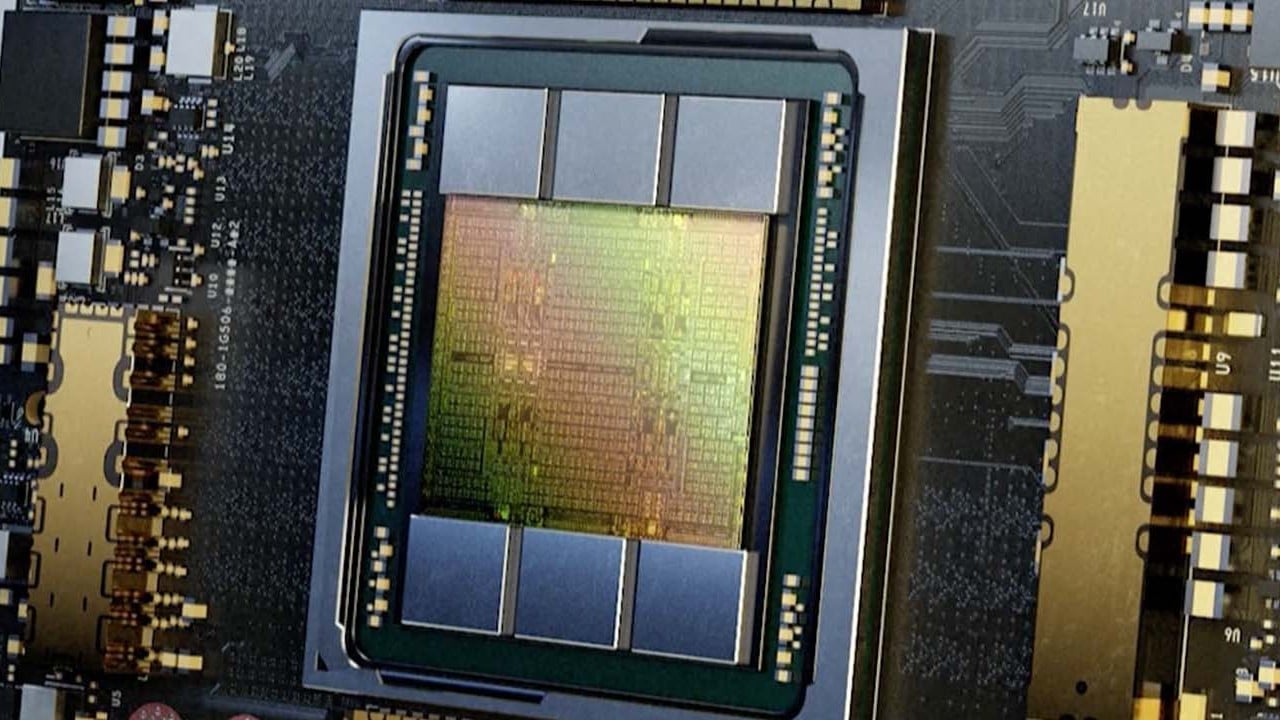

Moore Threads did not elaborate on which foundry produced its latest graphics cards. The company did not respond to a request for comment on Wednesday.

However, it has said that the KUAE computing facility only took 30 days to build and is compatible with Nvidia’s CUDA, the parallel computing platform and programming model developed by the US firm for general computing using its GPUs.

Moore Threads said its centre can finish training a 130-billion-parameter model within 56 days.

Under updated tech export controls announced by the US Commerce Department in October, Nvidia can no longer sell to Chinese companies its A800 and H800 chips, which had been designed to comply with Washington’s earlier rules.

Why China is still several moves behind in the AI chess game started by ChatGPT

Owing to the export curbs and surging interest in developing large language models, Nvidia GPUs have become highly sought after by Big Tech companies in China.

Baidu, ByteDance, Tencent Holdings and Alibaba Group Holding, owner of the South China Morning Post, have each spent billions of dollars stocking up on the chips, and the firms are expected to buy a total of 125,000 Nvidia H100 GPUs – 20 per cent of all H100 shipments in 2023 – according to data from research firm Omdia.

Moore Threads on Tuesday said it had teamed up with 15 partners – including 360 Security Technology, Baidu’s PaddlePaddle, JD.com’s Yanxi, NetEase, Tsinghua University and Fudan University – to establish a large model alliance.