Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices have continued to recover from their slide last year, with prices rising on an annual basis for the first time in over a year last month.

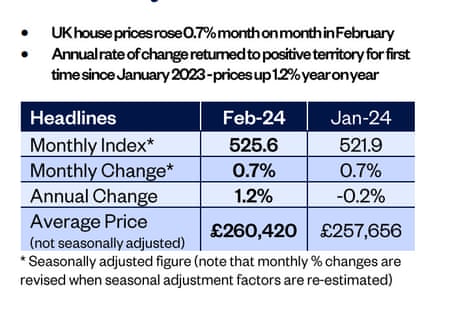

Lender Nationwide has reported that UK house prices were 1.2% higher than a year ago in February, having jumped by 0.7% during the month – the same monthly rise as in January.

This lifted the average price to £260,420, up from £257,656 in January, Nationwide reports.

Nationwides’s data is based on mortgages approved by the lender, and doesn’t capture cash buyers. It does suggest that the drop in mortgage rates following the surge last year is helping to bring buyers back to the market.

Robert Gardner, Nationwide’s chief economist, says:

“The decline in borrowing costs around the turn of the year appears to have prompted an uptick in the housing market.

Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries.

Gardner adds that “the near-term prospects remain highly uncertain”, partly due to ongoing uncertainty about the future path of interest rates.

He says:

After falling sharply in late December, swap rates, which underpin fixed rate mortgage pricing, have drifted back up.

Nationwide reports that house prices are now around 3% below the all-time highs recorded in the summer of 2022, once seasonal effects are taking into account.

February’s rise in prices follows a 0.7% rise during January, according to Nationwide’s data, which left prices 0.2% lower than a year ago.

Yesterday, Bank of England data showed that new mortgage approvals rose in January to their highest level since October 2022, although new lending was still subdued in historic terms:

There were 55,227 UK mortgage approvals in January 2024 according to the Bank of England. This is 7.2% higher than in December 2023 & 40.2% higher than the nadir in December 2022 (after the first spike in mortgage rates due to the Mini Budget)... #ukhousing pic.twitter.com/ggEgFsr49m

— Noble Francis (@NobleFrancis) February 29, 2024

Zoopla has reported this week that activity in the housing market has picked up; they forecast sales will rise 10% this year.

Also coming up today

We round off the week with a flurry of economic data, including the latest eurozone inflation reading and Brazil’s growth report. Factory surveys from across the world are expected to confirm another drop in activity in the eurozone and the UK.

China’s manufacturing downturn has continued, with activity shrinking for a fifth straight month in February.

This puts more pressure on Beijing to deploy new stimulus measures to support its economy.

China's official manufacturing purchasing managers' index (PMI), compiled by the National Bureau of Statistics (NBS), fell to 49.1 in February from 49.2 in January with a sizeable drop in the output component.

— Marco Castelli (@macastel3) March 1, 2024

Demand is weak both domestically and for export. pic.twitter.com/NvMPvHe0pY

Stock markets in Japan, Australia and India have all hit record highs today, as the equities rally continues.

The agenda

9am GMT: Eurozone manufacturing PMI for January

9.30am GMT: UK manufacturing PMI for January

10am GMT: Eurozone flash inflation reading for February

10am GMT: Eurozone unemployment report for January

Noon GMT: Brazil’s GDP report for Q4 2023

2pm GMT: Bank of England’s chief economist Huw Pill: gives a speech at the Cardiff University Business School

3pm GMT: US manufacturing PMI for January

3pm GMT: University of Michigan’s index of US consumer confidence