Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s the final trading day of 2023! And Nationwide, the building society, is kicking the day off by reporting that UK house prices have fallen by 1.8% over the last year.

That’s a smaller fall than expected at the start of the year, when some analysts predicted prices could fall by over 10%, as the market has picked up as mortgage rates fell this autumn.

On a monthly basis, the average house price dipped to £257,443, down from £258,557 in November.

Robert Gardner, Nationwide’s chief economist, says:

“UK house prices ended 2023 down 1.8% compared with December 2022, leaving them almost 4.5% below the all-time high recorded in late summer 2022. Prices were flat compared with November, after taking account of seasonal effects.

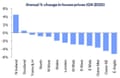

Nationwide’s latest house price report found that Northern Ireland and Scotland were the only parts of the UK to see prices rise in 2023.

Northern Ireland was the best performer in 2023, with prices up 4.5% over the year, while average prices in Scotland rose by 0.5%.

East Anglia was the weakest performing region, with prices down 5.2% over the year.

The broad picture is that “housing market activity was weak throughout 2023”, says Gardner, adding:

The total number of transactions has been running at c10% below pre-pandemic levels over the past six months, with those involving a mortgage down even more (c20%), reflecting the impact of higher borrowing costs.

On the flip side, the volume of cash transactions has continued to run above pre-Covid levels.

More details and reaction to follow…

Also coming up today

London stock market traders can knock off early today, with trading due to finish at lunchtime.

That will round off a year in which Britain’s FTSE 100 index has lagged behind other share indices. The UK’s blue-chip stock index has gained around 3.6%, while other European markets have gained over 12%.

Wall Street has also had a rather brighter year – last night, the Dow Jones industrial average hit its second record-high closing level in a row, and the S&P 500 inched even closer to its own alltime peak.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says the 2023 was completely different than what was expected.

Ozkardeskaya explains:

We were expecting the US to enter recession, but the US printed around 5% growth in the Q3.

We were expecting the Chinese post-Covid reopening to boost the Chinese growth and fuel global inflation, but a year after the end of China’s zero-Covid measures, China is suffocating due to an unexpected deflation and worsening property crisis.

We were expecting last year’s negative correlation between stocks and bonds to reverse – as recession would boost bond appetite but batter stocks. None happened.

Bond traders can also celebrate a strong end to a tricky year. In October, bond funds were facing their third year of losses in a row.

But now, the world’s debt market is on track to post its biggest two-month gain on record as traders ramp up expectations that central banks everywhere will slash interest rates next year.

The Bloomberg Global Aggregate Total Return Index has risen nearly 10% over November and December, its best two-month run in data going back to 1990.

The agenda

7am GMT: Nationwide’s house price index for December

12.30pm GMT: London stock market closes early for the new year

2.45pm GMT: The Chicago PMI for company growth in the Chicago region

Jeremy Leaf, north London estate agent, say this morning’s report from Nationwide shows “house price resilience”, adding:

“Lower inflation and strong employment figures are reducing the sting of serious price rises and providing a more balanced market as we move into 2024.

“Looking forward, we see a slightly more positive outlook, with is likely to result in more transitions and prices bumping along a little lower over the next few months at least.”

There is growing evidence that the worst of the UK’s house price correction is behind us, argues Tom Bill, head of UK residential research at estate agent Knight Frank.

Bill predices that the housing market will return to normality in 2024 – although the looming general election could cast a shadow.

He says:

As inflation falls, downwards pressure on mortgage rates means demand should strengthen and transaction numbers will move closer to their longer-term norms in 2024.

A tight jobs market, the availability of longer mortgages, the fact more homes are owned outright than with a mortgage and the absence of forced selling due to tougher mortgage stress-testing rules since the global financial crisis have all helped avoid steeper price declines as interest rates normalise.

Pre-election giveaways may boost sentiment further next year although the UK housing market is likely to stutter ahead of the vote itself.”

According to lender @AskNationwide House “prices” ended the year down 1.8% on last year, making the AVG house price in Dec 23, £257,443, 4.5% ⬇️ from their Sep 22 peak. pic.twitter.com/JTzz3NSODD

— Emma Fildes (@emmafildes) December 29, 2023

Price drops varied across Eng with East Anglia performing the worst, ⬇️ 5.2%. Only Northern Ireland & Scotland saw prices prosper bolstering end of year house price results with lender @AskNationwide pic.twitter.com/bLdrdMqZc1

— Emma Fildes (@emmafildes) December 29, 2023

A rapid rebound in activity or house prices in 2024 appears unlikely, warns Nationwide’s Robert Gardner.

Looking ahead, Gardner say:

“There have been some encouraging signs for potential buyers recently, with mortgage rates edging down. Investors have become more optimistic that the Bank of England has already raised rates far enough to return inflation to target and will reduce rates in the years ahead. This shift in view is important, as it has brought down longer-term interest rates, which underpin fixed mortgage rate pricing.

“Nevertheless, a rapid rebound in activity or house prices in 2024 appears unlikely. While cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, consumer confidence remains weak and surveyors continue to report subdued levels of new buyer enquiries. Moreover, while markets are projecting that the next Bank Rate move will be down, there are still upward risks to interest rates. Inflation is declining, but measures of domestic price pressures remain far too high.

“It appears likely that a combination of solid income growth, together with modestly lower house prices and mortgage rates, will gradually improve affordability over time, with housing market activity remaining fairly subdued in the interim. If the economy remains sluggish and mortgage rates moderate only gradually, as we expect, house prices are likely to record another small decline or remain broadly flat (perhaps 0 to -2%) over the course of 2024.

UK house prices fell faster in the south of England than the north this year, Nationwide’s new house price index shows.

Robert Gardner, Nationwide’s chief economist, explains:

“Across northern England (which comprises North, North West, Yorkshire & The Humber, East Midlands and West Midlands), prices were down 1.8% year on year. Yorkshire & The Humber was the best performing northern region with an annual rate of change of -0.5%.

“Meanwhile southern England (South West, Outer South East, Outer Metropolitan, London and East Anglia) saw a 3.4% year-on-year fall.

London was once again the best performing southern region with a 2.4% annual decline.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s the final trading day of 2023! And Nationwide, the building society, is kicking the day off by reporting that UK house prices have fallen by 1.8% over the last year.

That’s a smaller fall than expected at the start of the year, when some analysts predicted prices could fall by over 10%, as the market has picked up as mortgage rates fell this autumn.

On a monthly basis, the average house price dipped to £257,443, down from £258,557 in November.

Robert Gardner, Nationwide’s chief economist, says:

“UK house prices ended 2023 down 1.8% compared with December 2022, leaving them almost 4.5% below the all-time high recorded in late summer 2022. Prices were flat compared with November, after taking account of seasonal effects.

Nationwide’s latest house price report found that Northern Ireland and Scotland were the only parts of the UK to see prices rise in 2023.

Northern Ireland was the best performer in 2023, with prices up 4.5% over the year, while average prices in Scotland rose by 0.5%.

East Anglia was the weakest performing region, with prices down 5.2% over the year.

The broad picture is that “housing market activity was weak throughout 2023”, says Gardner, adding:

The total number of transactions has been running at c10% below pre-pandemic levels over the past six months, with those involving a mortgage down even more (c20%), reflecting the impact of higher borrowing costs.

On the flip side, the volume of cash transactions has continued to run above pre-Covid levels.

More details and reaction to follow…

Also coming up today

London stock market traders can knock off early today, with trading due to finish at lunchtime.

That will round off a year in which Britain’s FTSE 100 index has lagged behind other share indices. The UK’s blue-chip stock index has gained around 3.6%, while other European markets have gained over 12%.

Wall Street has also had a rather brighter year – last night, the Dow Jones industrial average hit its second record-high closing level in a row, and the S&P 500 inched even closer to its own alltime peak.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says the 2023 was completely different than what was expected.

Ozkardeskaya explains:

We were expecting the US to enter recession, but the US printed around 5% growth in the Q3.

We were expecting the Chinese post-Covid reopening to boost the Chinese growth and fuel global inflation, but a year after the end of China’s zero-Covid measures, China is suffocating due to an unexpected deflation and worsening property crisis.

We were expecting last year’s negative correlation between stocks and bonds to reverse – as recession would boost bond appetite but batter stocks. None happened.

Bond traders can also celebrate a strong end to a tricky year. In October, bond funds were facing their third year of losses in a row.

But now, the world’s debt market is on track to post its biggest two-month gain on record as traders ramp up expectations that central banks everywhere will slash interest rates next year.

The Bloomberg Global Aggregate Total Return Index has risen nearly 10% over November and December, its best two-month run in data going back to 1990.

The agenda

7am GMT: Nationwide’s house price index for December

12.30pm GMT: London stock market closes early for the new year

2.45pm GMT: The Chicago PMI for company growth in the Chicago region